The Informal Funds Transfer system of Havala is alive, well and enjoys

global growth

While the established global Banking and Financial Institutions

and System continue to debate the one-size-fits-all and ongoing Basel reforms,

now at no. IV and the Bank for International Settlements is once again rewriting

the rules that govern the banks capital to mitigate their exposures to different

types of risks, and while oversight authorities focus on specific models

to measure Counterparty Credit Risk Exposures, there is an age-old parallel

system of transferring money and performing other monetary transactions

that are completely out of the officially governed oversight radar, scope

and view. It's called Hawala or the poor man's Bitcoin.

Are the current banking and financial

system out-of-date?

To address the regulatory overreach of existing credit risk calculations,

continued the introduction of significantly more complex models with added

controls for asset classes and rules regarding the treatment of particular

product sets, mean that the western financial institutions are all the

time trying to implement and achieve check-the-box compliance.

Western firms are already learning from the Hawala system to cut the cost

of international money transfers. Instead of moving customers' money electronically,

and charging hefty fees, other systems directly match people with money

and then 'deposit' the funds into their local bank accounts. Other technology

firms, such as Apple, Facebook, Google, and Bitcoin are also getting in

on the money transfer business in their way, to bypass the overreaching

regulation by digitising the Hawala methodology.

Hawala (Arabic: meaning transfer), also known as hundi in India is an

informal value transfer system, based on the performance and honour of

a huge network of money brokers, originally located in the Middle East,

Africa, Asia and the Indian subcontinent. They operate outside of, or

parallel to, traditional banking, financial channels, and remittance systems.

The Informal Funds Transfer (IFT) systems have been for centuries used

for trade financing. They were created because of the dangers from thugs

and bandits. In China and East Asia, they go under Fei-Ch'ien (China),

Padala (Philippines), Hundi (India), Hui-Kuan (Hong Kong), and Phei Kwan

(Thailand) and continue to be in daily use.

The hawala (or hundi) system now enjoys widespread global use but is historically

associated with South Asia and the Middle East. Due to globalisation and

migration, the primary users are members of expatriate communities across

the globe. The immigrant workers and entrepreneurs have reinvigorated

the system's role and importance. While Hawala can also be used to legitimate

the transfer of funds. Due to the anonymity and minimal documentation,

the system is vulnerable to abuse by individuals and groups that transfer

funds to finance illegal activities.

Effects of designing and implementing monetary, fiscal, and financial

sector regulatory policies

Since informal funds transfers are conducted outside the formal banking

system activity, they are not subject to taxes on income and services.

Like any underground business, IFT systems also entail a loss of business

for the formal financial sector and thereby of potential government income.

The International Monetary Fund is concerned that the rapid increase of

this parallel system

- Reduces the reliability of statistical information available to

policymakers.

- Effectively limits the significance of economic data by underestimating

the factors that affect individual economic aggregates, including

national accounts.

- Have negative fiscal implications for both remitting and receiving

countries.

Hawala probably running in the trillions

The full extent of Hawala systems has not been explored and cannot be

quantified reliably and accurately given the informal nature of the transactions.

It is likely that it ranges to billions of USD. Based on estimates of

the expatriate community and balance of payment data, Pakistan, officials

estimate that more than 10 billion usd while Interpol estimates the size

of Hawala in India to be at 40% of the country's gross domestic product.

What happens in China is anybody's guess.

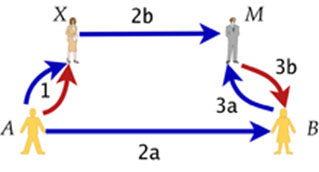

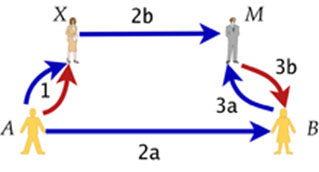

The Hawala transaction. See details in the source for an explanation

Figure source: https://en.wikipedia.org/wiki/Hawala

http://www.un.org/esa/desa/papers/2002/esa02dp26.pdf