The 2015 Tone-at- the-Top worry is on Reputational Risk

While executive directors often blame regulatory risks

for taking much of their time, the concern for reputation risks has grown

over the years. The high-profile media coverage e.g. the BP oil spill in

the Gulf of Mexico, the global LIBOR and HSBC scandals, that has lead to

even greater banking regulation. The FIFA scandal that continued for a couple

of decades, before US authorities put their foot down, or Petrobras scandal

in Brazil, has changed the tone-at-the-top agenda.

The anatomy of a corporate scandal is

often due to the lack of consequent tone-at-the Top. This lack consequential

management of board responsibilities is detrimental to the ethical organisational

climate. The outcome is lack of transparency, accountability, and oversight,

resulting in fraudulent financial reporting or messy and disorganised

internal control, auditing, and governance. Later all hell breaks loose

when the company faces the consequences of the bubble economy and/or market

pressures. This scenario has been the primary cause of the past two crisis.

When Sarbanes-Oxley (SOX) was introduced in 2004, there was an overwhelming

focus on internal control and compliance. The board of directors and the

CEO/CFO were caught up in the regulation of small issues. The heavy fuss

and commotion for SOX compliance has resulted in CEO/CFO not taking a

step back and looking at some of the big things or looking at risk as

a comprehensive GRC scenario.

Reputational risks are at the core of profit and value creation

A decade down the compliance road, the CEO/CFO now view reputational risk

as their primary concern, right after financial risks as their number

one priority. Regulatory risks come in third.

The increase in concerns for reputational risk must be seen in connection

with the most operational risks like product quality, liability, and customer

satisfaction that are always at the core of profit and value creation.

However corporate concerns for integrity, fraud, ethics, and corruption

are also ion the rise.

Therefore, the focus of the 9th annual European GRC Summit at the World

Trade Center in Stockholm on the 22-23rd September focuses to provide

multiple answers on these issues as there is no one size fits all solution.

http://www.copenhagencompliance.com/2015/stockholm/

Take a step back and look at the big issues

The conference focuses on providing guidance and information on broad-based

risk assessment. This indicates a major interest in keeping up-to-date

on risk holistically, according to the survey. Almost half said that a

group of concerns including cybersecurity, protecting reputational risk,

and being current with regulatory compliance issues was topics they want

to know more about.

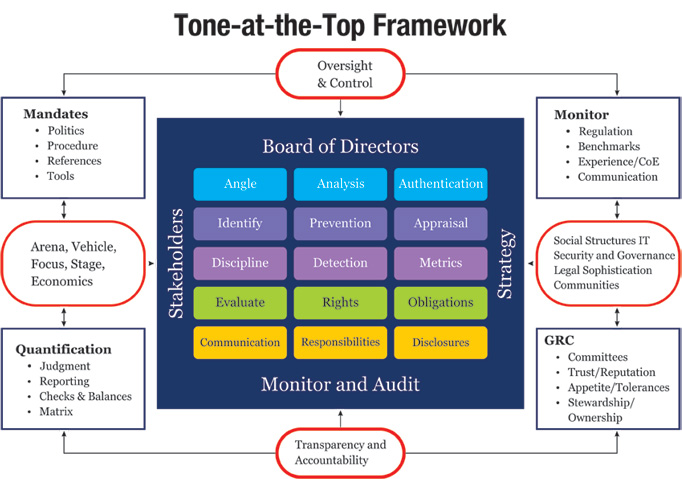

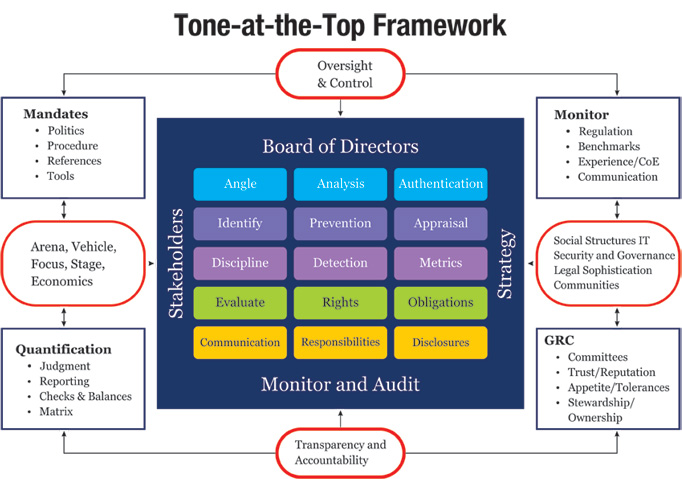

In 2015, management looks at risk as a big picture. With the added components

of governance and compliance management can then take a step back and

looking at some of the big issues that the business can face in the future.

Ask these 3 questions before developing a customized Tone-at-the-Top

framework;

- Have we defined the quantitative measures, balanced with a qualitative

evaluation of the current tone-at-the-top? (All Copenhagen ComplianceŽ

GRC structures and frameworks can be quantified for measurement, management,

and monitoring)

- Do we have enough focus on soft controls in the internal audit function

to evaluate the major tone-at-the-top components?

- Is the tone-at-the-top perception of operating units, functions

and the roles of managers in line with the overall strategy and mission/vision

of the organisation.

In the next newsletter see: Approaches to Assessing the Tone-at-the-Top